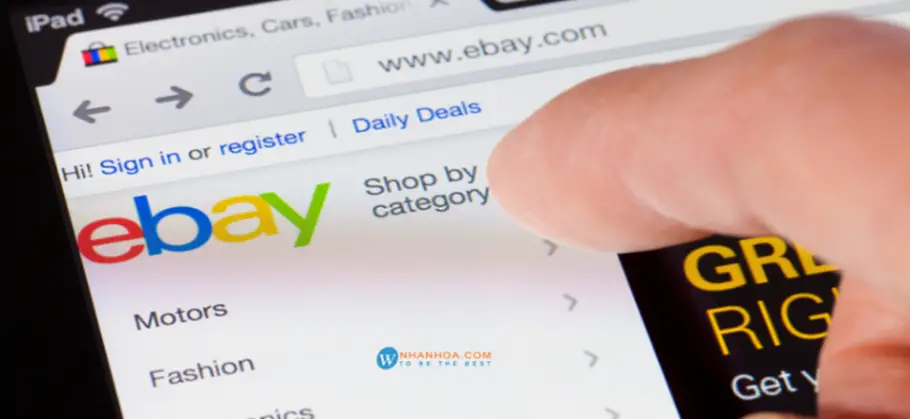

Does eBay charge tax on shipping? Let’s find out! With the rise of e-commerce, taxes on shipping goods have become an increasingly pressing issue. Nowhere is this more evident than with eBay, which has seen a large surge in sales over the past decade.

As eBay and its users adjust to changing regulations, it is important to understand how taxes can affect those who buy and sell items on the platform. This article will look at how taxes are applied to eBay shipping, including fees for sellers and buyers across different states.

Does eBay charge tax on shipping?

The answer depends on where you live and the seller’s location. Generally speaking, eBay doesn’t levy taxes on shipping fees itself; however, certain states require that shipping and handling tax be applied to any transaction within their borders. So if you’re buying from a seller in your own state, they may well have to include the relevant taxes in their shipping costs.

In cases where the item is shipped from another state (or country), no taxes are typically charged by eBay itself. But again, there may be local or state taxes imposed by governments that apply in these cases too – so be sure to check before making a purchase.

eBay Tax Exemptions

For many shoppers, eBay offers an opportunity to save money on the items they purchase by avoiding sales tax. To take advantage of these savings, buyers must understand the rules and requirements for eBay tax exemptions.

When shopping on eBay, buyers may be asked to pay taxes for their purchases. However, some states allow certain entities such as charitable organizations or resellers to submit a resale certificate in order to avoid paying taxes on an eBay purchase.

In order to qualify for exemption based on this certificate, buyers must provide proof that they meet all criteria outlined by their state’s Department of Revenue or similar agency.

Also Read // Does Mercari charge sales tax? (Answered)

eBay seller tax responsibilities

For many entrepreneurs, selling goods on eBay is an attractive option for earning money. However, before jumping in to the world of e-commerce, it’s important to understand the tax responsibilities associated with being an eBay seller.

Knowing the rules and regulations of taxes related to selling goods on eBay can help sellers maximize their profits and remain in compliance with federal and state laws.

When it comes to taxes, all eBay sellers must register with their respective state tax agencies prior to starting a business. This process will determine whether or not a sales tax needs to be collected from buyers for each transaction.

Depending on the location of both parties involved in the transaction (seller and buyer), there may also be additional local taxes that need to be taken into consideration. Additionally, sellers are responsible for filing income taxes based on their profits from sales at the end of each year.

eBay buyer tax responsibilities

For buyers, the most important thing to keep in mind is that any goods or services purchased through eBay are subject to state sales taxes. Depending on which state you live in, this could mean that you need to pay additional taxes on items purchased through the platform.

Additionally, if goods are shipped out of state then this could also affect the type of taxes you need to pay. For example, if an item is shipped from another country then customs duties may apply.

Also Read // How to tell if eBay seller is legit (14+ Things to Check)

Conclusion: Final Thoughts

In conclusion, eBay is a great platform for millions of sellers to earn extra income and build a business. All sellers should remember that with the opportunity comes responsibility. As an eBay seller, it is important to be aware of your tax obligations and make sure that you are compliant with all applicable laws.

Furthermore, taking advantage of the resources available from eBay can help you ensure that you are up-to-date on your taxes and take full advantage of deductions and other benefits.

Also Read // Is Mercari safe for credit cards? (MUST READ)