As with any car rental, insurance coverage is a crucial consideration. In this comprehensive guide, we delve into the question, “Does Farmers Insurance Cover Turo?” to provide you with valuable insights and up to date information.

We will explain whether Farmers Insurance provides coverage for Turo car rentals and you will get insights, answers to FAQs, and expert advice on understanding the extent of coverage.

In the modern era of shared economies and innovative transportation solutions, services like Turo have gained immense popularity.

Turo allows individuals to rent their personal vehicles to others, providing a flexible and convenient alternative to traditional car rental companies.

Does Farmers Insurance Cover Turo?

Yes, Farmers Insurance does offer coverage for vehicles rented out on platforms like Turo. Farmers Insurance recognizes the evolving landscape of transportation and has adapted its coverage options to address the needs of its policyholders. However, there are important details and factors to consider.

Key Coverage Considerations

When it comes to Turo rentals, Farmers Insurance offers options that policyholders should be aware of:

1. Personal Auto Policy Extension

Farmers Insurance provides a Personal Auto Policy Extension that allows coverage to extend to a vehicle rented through peer-to-peer platforms like Turo.

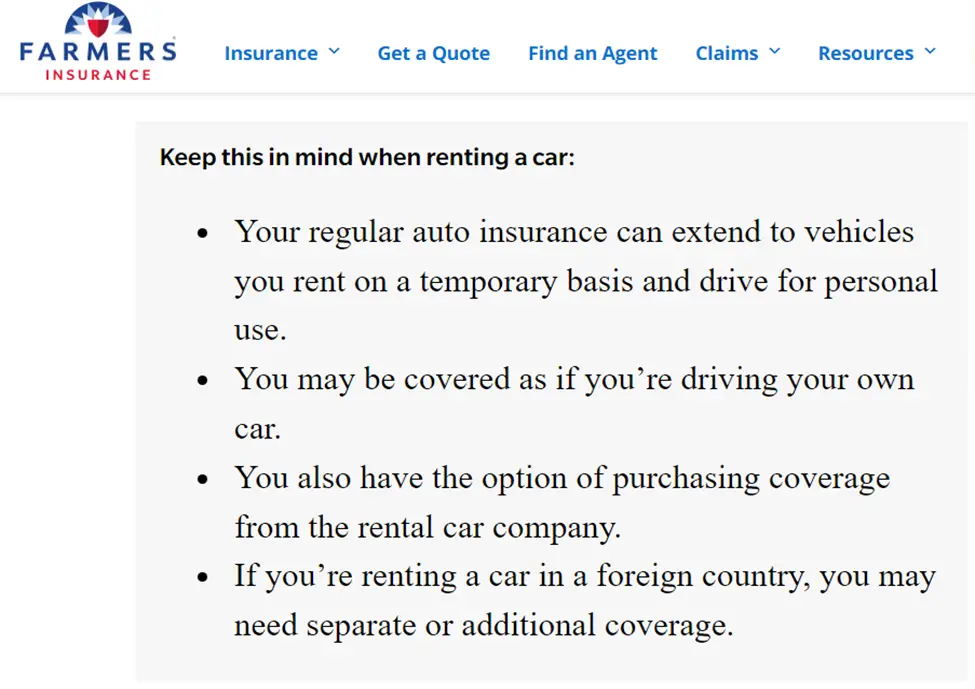

This extension typically includes liability coverage and, in some cases, physical damage coverage, subject to the terms and conditions of the policy. Below are the key points to understand for Farmers Auto Policy.

2. Coverage Limits

It’s important to understand the limits of coverage provided by Farmers Insurance. Coverage limits for rented vehicles might differ from those for your personal vehicle.

Ensure you’re familiar with the liability limits and deductibles that apply specifically to Turo rentals. Below is what to keep in mind when renting a car from Farmers Insurance website!

3. Physical Damage Coverage

While liability coverage might be included in the extension, physical damage coverage (comprehensive and collision) might not be automatically provided. You may need to explore additional options or endorsements to ensure adequate protection for your rented vehicle.

| Farmers Insurance Contact US Information | |

| Customer Care Center | From getting a quote to paying your bill to filing a claim, here’s how to reach them whenever and wherever you are:Call them using this number 888-327-6335For other products, fill out this request form |

| Working Hours | Monday – Friday 7:00 a.m. to 11:00 p.m. CSTSaturday – Sunday 8:00 a.m. to 8:00 p.m. CST |

4. Rental Period Considerations

Farmers Insurance coverage for Turo rentals is likely to apply during the rental period agreed upon in the Turo reservation. Be aware of any restrictions or limitations on coverage duration.

5. Pre-existing Damage

Documenting the condition of the vehicle before and after the rental period is crucial. Farmers Insurance might require proper documentation of any pre-existing damage to the vehicle before extending coverage.

Benefits of Using Farmers Insurance for Turo

Opting for Farmers Insurance to cover your Turo activities comes with several benefits:

- Comprehensive Protection: With specialized coverage options like Ride Sharing and Business Auto Coverage, Farmers Insurance addresses the unique risks associated with car-sharing platforms.

- Trusted Provider: Farmers Insurance brings its legacy of reliability and customer service to the realm of car-sharing, fostering a sense of security for hosts and guests alike.

- Tailored Solutions: The flexibility of Farmers Insurance policies allows hosts to select coverage that aligns with their level of Turo involvement, ensuring cost-effectiveness and appropriate protection.

Conclusion

In conclusion, if you’re considering using Turo to either rent out your vehicle or rent one for yourself, Farmers Insurance does offer coverage options to protect your interests. However, it’s essential to have a clear understanding of the coverage limits, options, and any additional steps you might need to take.

The evolving nature of the sharing economy underscores the importance of proactive communication with your insurance provider. For the most accurate and up-to-date information, always consult with your local Farmers Insurance agent before making any decisions.

Remember, navigating insurance coverage can sometimes be complex, so seeking expert guidance is never a bad idea. Now that you’re armed with information, you can confidently explore the world of Turo with a solid understanding of how your Farmers Insurance policy comes into play.

Frequently Asked Questions

Does Farmers Insurance Cover Turo rentals in all states?

Farmers Insurance’s coverage for Turo rentals may vary by state. It’s advisable to check with your local Farmers Insurance agent to understand the specific coverage options available in your state.

Can I rely solely on my existing Farmers Insurance policy for Turo rentals?

While your existing policy might offer some coverage, it’s recommended to discuss your Turo rental plans with your Farmers Insurance agent. They can help you understand any gaps in coverage and suggest suitable solutions.

How do I add coverage for Turo rentals to my Farmers Insurance policy?

Adding coverage for Turo rentals might involve adjusting your policy or adding specific endorsements. Get in touch with your Farmers Insurance agent to explore the necessary steps.

What should I do in case of an accident during a Turo rental?

In case of an accident, follow the standard procedures outlined by Farmers Insurance. Document the incident, gather information, and notify your insurance provider as soon as possible.

Are rental vehicles of all types covered under the extension?

Coverage availability might vary based on the type of vehicle you’re renting. Some vehicle categories, such as luxury or exotic cars, might have different coverage considerations.

Are there any restrictions on the rental duration for coverage to apply?

While coverage is generally provided for the rental period agreed upon with Turo, there might be limitations on extended rental durations. Check with your Farmers Insurance agent for clarity.

Also Read: Does Allstate Car Insurance Cover Turo Rentals? [MUST READ]