Curious about how does Kiva make money? This comprehensive article delves into the various revenue streams and business model of Kiva, a pioneering online micro-lending platform. You will learn how Kiva sustains itself while empowering individuals around the world.

Kiva, a revolutionary online lending platform, has captured the hearts of millions by connecting lenders to borrowers in developing countries. Founded in 2005, Kiva’s mission is to alleviate poverty by enabling people to lend small amounts of money to aspiring entrepreneurs and low-income individuals.

As you embark on this journey to understand the financial workings of Kiva, we’ll explore the key revenue streams and business strategies that enable the organization to make a positive impact globally.

How does Kiva make money?

Kiva operates on a unique money making model that combines philanthropy with financial sustainability. Its main revenue sources are transaction fees, optional donations, grants and sponsorships, interest spread, and strategic partnerships. Let’s delve deep into the individual ways Kiva generates revenue:

| Strategy | Description |

| 1. Transaction Fees | Kiva charges a nominal fee to borrowers on the platform for facilitating the loan transactions. This fee contributes significantly to its revenue stream. |

| 2. Optional Donations | Kiva allows lenders to make optional donations to support the platform’s operations. These voluntary contributions play a crucial role in sustaining Kiva’s mission. |

| 3. Grants and Sponsorships | Kiva receives grants and sponsorships from foundations, corporations, and individuals who believe in its cause. These contributions aid in covering operational expenses. |

| 4. Interest Spread | Kiva partners with local microfinance institutions (MFIs) in the countries where it operates. The interest charged by the MFIs to borrowers is typically higher than the interest Kiva pays to lenders. The difference in interest rates, known as the interest spread, helps Kiva cover administrative costs. |

| 5. Kiva U.S. Operations | Kiva has expanded its scope beyond international lending. It now offers loans for small businesses in the United States. The interest earned from these loans adds to Kiva’s revenue. |

| 6. Strategic Partnerships | Kiva collaborates with various organizations and corporations to leverage their reach and resources, thereby generating additional revenue streams. |

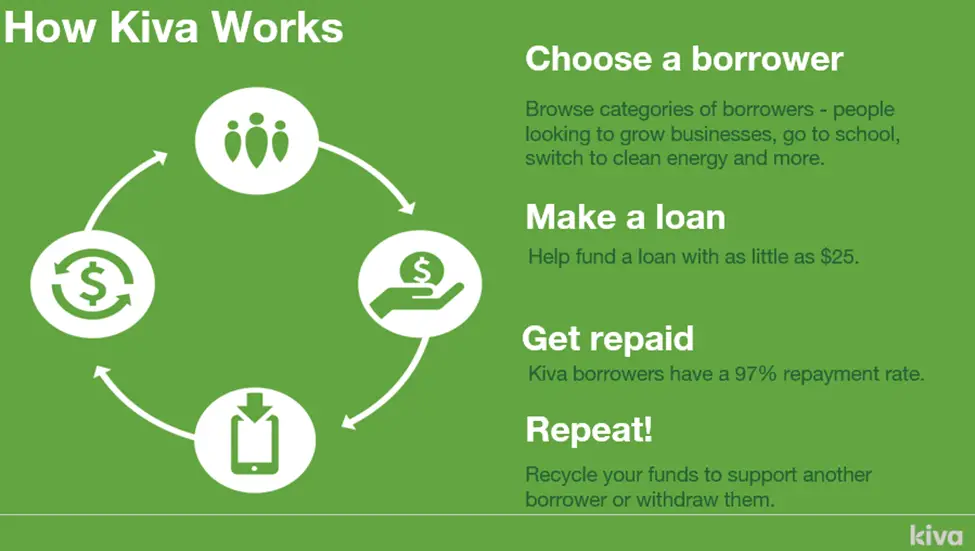

How does Kiva work?

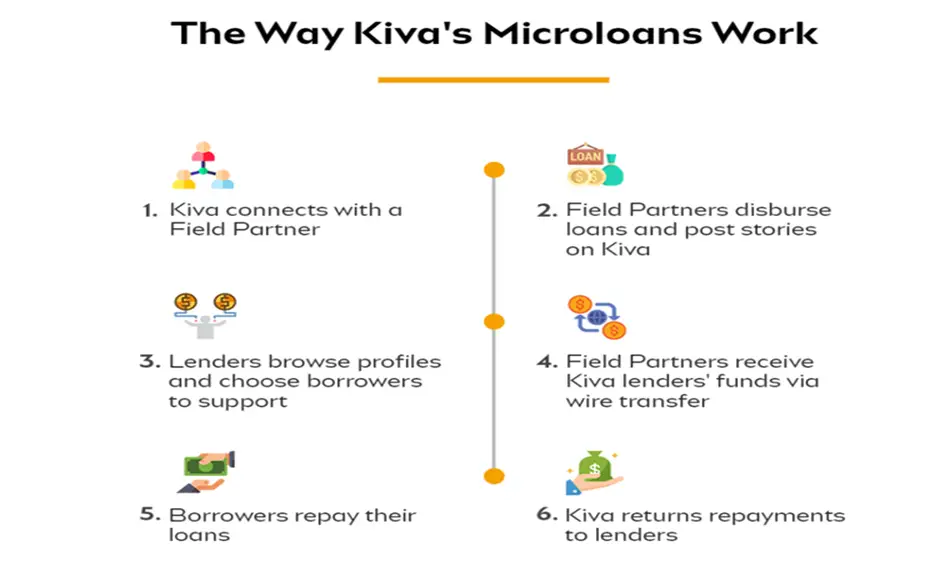

Kiva allows individuals to loan as little as $25 to entrepreneurs in developing countries. The Kiva Loans can be used for a variety of purposes, including business expansion, education, and housing.

Since its inception, Kiva has facilitated over $1 billion in loans to entrepreneurs in over 87 countries. Not only does Kiva provide access to capital but it also helps to create jobs and boost local economies.

Kiva’s Approach to Micro financing

Kiva’s approach to micro financing is based on trust, transparency, and accountability. All of Kiva’s loan transactions are public, so lenders can see where their money is going. Kiva also partners with local organizations to provide support for borrowers.

Kiva’s approach to micro financing is based on the belief that everyone has the power to create change in their community. Meaning the borrower can use the money to develop themselves and grow their businesses without having to worry about paying an expensive loan.

Kiva Loan Requirements

All Kiva borrowers are required to meet the following criteria to qualify for a loan:

- Borrower’s Location: Kiva operates in various countries worldwide, and borrowers must be from the eligible regions where Kiva operates.

- Entrepreneurial Purpose: Kiva loans are intended for income-generating activities, such as starting or expanding a small business.

- Field Partner Involvement: Kiva collaborates with local microfinance institutions or field partners who screen and endorse borrowers. Borrowers must connect with a Kiva-approved field partner to access the loans.

- Social Impact: Kiva prioritizes loans that have a positive social impact and help alleviate poverty or support underserved communities.

- No Credit History Required: Borrowers may not need a traditional credit history to qualify for a Kiva loan, as the loans are often designed for individuals with limited access to formal financial institutions.

- Loan Size: Kiva offers microloans, which are typically smaller in size compared to traditional bank loans. The maximum loan amount varies based on the field partner and the country’s regulations.

- Interest Rates: Kiva loans often have low or zero interest rates. The interest charged by the field partner, if any, must be reasonable and in compliance with local laws.

- Repayment Terms: Borrowers are expected to repay the loan over a specified period. Kiva loans usually have flexible repayment terms to accommodate borrowers with irregular income streams.

- Personal Story: Borrowers create a profile on the Kiva website, sharing their personal and business details. This profile is then used to crowdfund the loan from individual lenders around the world.

- Lender Engagement: Kiva operates on a crowdfunding model, where individual lenders contribute small amounts to fund a borrower’s loan. Borrowers may need to actively engage with their lenders by providing updates on their business progress.

- Collateral: Kiva loans are often uncollateralized, meaning borrowers may not need to pledge assets as security for the loan.

Kiva FAQs

How does Kiva ensure transparency in its revenue allocation?

Kiva maintains a transparent financial model, where detailed information about revenue allocation is accessible on their website. This ensures lenders and donors know exactly how their contributions are utilized.

Is Kiva a non-profit organization?

Yes, Kiva is a non-profit organization. While it seeks financial sustainability, its primary objective is to alleviate poverty rather than generate profits.

Can lenders make a profit on Kiva loans?

No, lenders do not earn interest or profit on their loans. Kiva operates on the principle of lending, not investing, where the primary goal is to support borrowers in need.

How can I become a lender on Kiva?

To become a lender, simply create an account on Kiva’s website, browse through available loan opportunities, and choose the borrowers you wish to support.

Does Kiva have repayment rates?

Yes, Kiva maintains impressive repayment rates, as borrowers are motivated to repay their loans and build a strong credit history.

Can I get a loan from Kiva?

Kiva primarily offers loans to borrowers in underserved communities in developing countries. However, it also provides small business loans within the United States.

Conclusion

Kiva has redefined the concept of lending by enabling people from all walks of life to make a meaningful difference in the lives of others. Through their innovative approach to micro-lending and strategic partnerships, Kiva has successfully impacted millions of lives, fostering sustainable development and empowerment.

By understanding how Kiva makes money, we can appreciate the organization’s dedication to social impact and financial transparency. Next time you lend through Kiva, remember the incredible stories of hope and progress that your contribution is supporting. Let’s continue to build a world where everyone ha

Also Read: How does Bilibili make money? (Answered)