This article answers the question; Can you get scammed on Zelle? Zelle is a digital payment service provider that allows users to send and receive money instantly.

It is owned by Early Warning Services LLC, a consortium of banks including Bank of America, JPMorgan Chase, and Wells Fargo. Zelle was first launched in 2017 as an easy way for bank account holders to transfer funds securely online or through the app.

Using Zelle is straightforward; all you need to do is link your accounts with your email address or mobile phone number. You can then start sending money quickly and easily without having to worry about cash or checks.

The transactions are fast too – usually taking less than 30 minutes for the recipient to receive their funds. And best of all, it’s free! There are no fees when you use Zelle either as a sender or receiver of money.

Can you get scammed on Zelle?

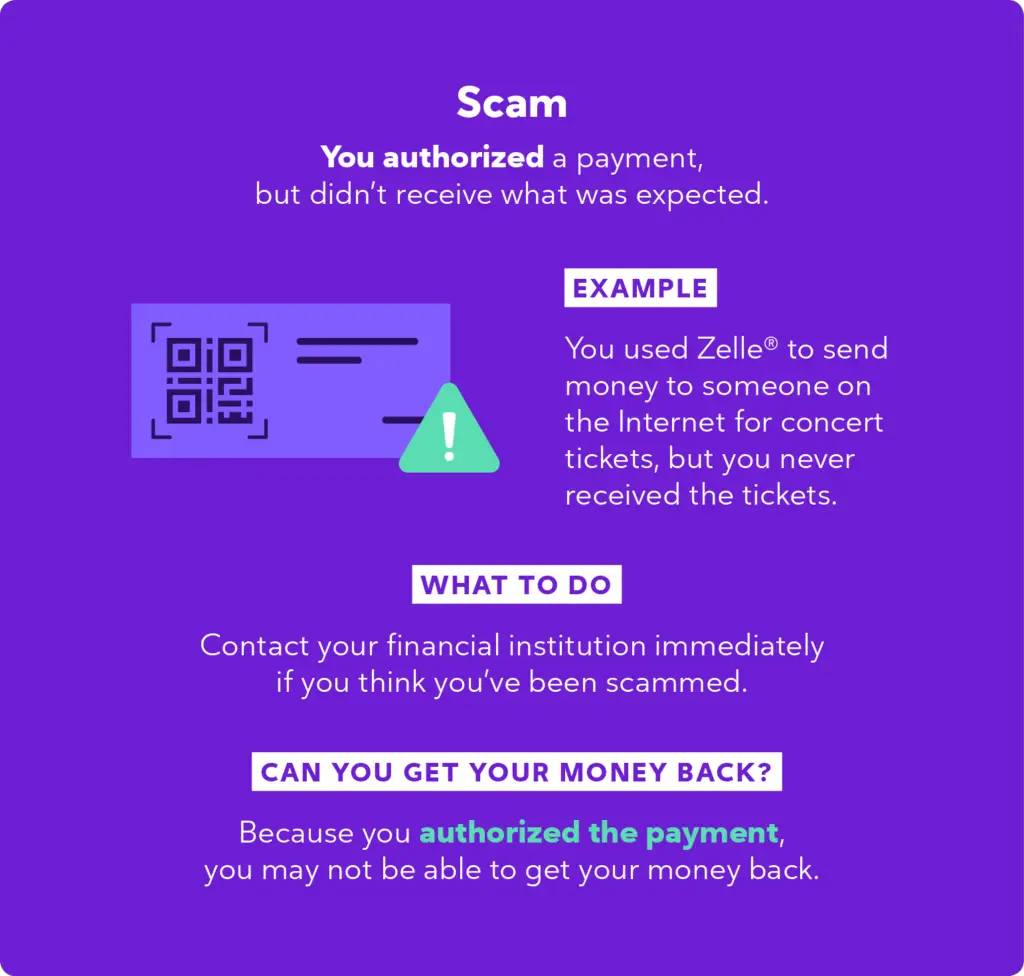

Yes, it is possible to be scammed when using Zelle. Here is how! As the world of digital payments grows, so does the potential for scams. Users of Zelle are vulnerable to scammers who seek to take advantage of unsuspecting individuals. For example, criminals may contact users claiming they need a loan or donations for a charity or cause.

They may also ask users to accept payment through Zelle in exchange for goods or services that never materialize. Additionally, hackers can use malware-infected computers and smartphones to gain access to user accounts and steal personal information stored on them.

How Scams Work on Zelle

Common scams on Zelle include phishing attempts where criminals try to obtain personal information such as bank account numbers or passwords by pretending to be from a legitimate organization; impersonation scams in which criminals pose as someone else in order to trick victims into sending money; and “money mule” schemes that involve transferring funds from an individual’s account without their knowledge.

Also Read // Can you get scammed on Poshmark as a seller? (MUST READ)

Warning Signs of a Scam on Zelle

As the digital payments industry grows and more consumers turn to electronic payment options like Zelle, it’s important to remain aware of the potential for scams.

Scammers have become increasingly adept at creating convincing stories in order to take advantage of unsuspecting users. While Zelle works hard to protect its users from fraudulent activity, there are a few warning signs that can help alert you to a potential scam.

The first sign of a scam attempt on Zelle is an unexpected request for money. While your family and friends may use Zelle to send money or ask for assistance with bills, scammers often try to disguise themselves as someone close to you in order to trick you into sending them funds.

If someone sends you an unexpected request – even if they appear familiar – it’s best not to respond right away. Take your time and verify their identity before sending any funds.

Scam Prevention Tips for Zelle Users

There are several tips that can help protect your funds when using Zelle. First and foremost, only use Zelle with people you know. This means avoiding any transactions with strangers or people you haven’t met in person.

It’s also important to double-check all information before sending money – make sure the payee’s name matches exactly what is on their account and confirm their contact details as well.

Additionally, never send large amounts of money via text message or email communications – these requests may be part of a scam attempt and may not be followed through later on.

What to do if you Are Scammed on Zelle

If you’ve been scammed on Zelle, don’t panic. There are steps you can take to help protect yourself and your finances.

First and foremost, contact the person who received the payment from you with whom you believe was involved in a scam. Ask them to refund your money or to cancel the transaction if possible. If that fails, then contact Zelle customer support. They will attempt to locate and dispute any unauthorized transactions sent from your account.

Next, keep records of all information regarding the fraudulent activity such as dates, times and amounts of payments sent and received, email addresses associated with the transaction etc., This information may be requested by law enforcement or other parties involved in resolving any disputes related to fraudulent activity on Zelle.

Conclusion: Be Proactive with Security

To stay secure while using Zelle, use caution when sending money and pay attention to payment details before submitting them. Verify the recipient’s email or phone number by contacting them independently before you make a payment.

When receiving payments on Zelle, make sure that you trust the sender and never provide your banking information or other personal information to someone you don’t know.

If something does not seem right about the request for payment do not proceed with it. Additionally, keep track of your transactions by monitoring emails sent from Zelle regarding activity on your account.

Also Read // Can you get scammed on Mercari?(MUST READ)