This article is your definitive guide to understanding “How does Wagestream make money?” We’ll dissect their revenue model, uncovering the intricate strategies that power their financial ecosystem.

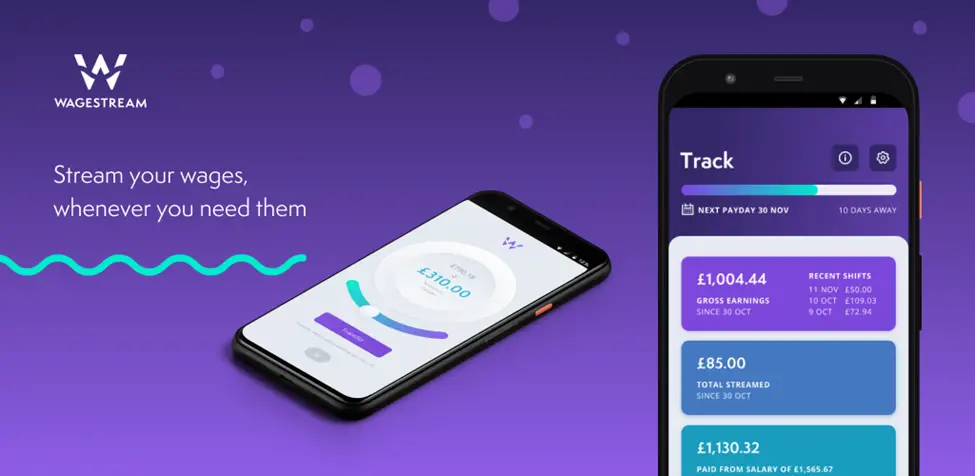

In the realm of financial technology, Wagestream has emerged as a trailblazer, transforming the way employees access their earned wages before the traditional payday

This not only empowers employees by providing financial flexibility but also enhances their overall well-being. The model operates by forging partnerships with employers, thereby creating a win-win situation for all parties involved.

How does Wagestream Make Money?

Wagestream adopts a multifaceted approach to generating revenue, rooted in its innovative solution to improve financial flexibility for employees. Here’s a breakdown of how Wagestream harnesses its revenue streams:

1. Service Fees: Empowering Financial Flexibility

Wagestream offers employees the option to access a portion of their earned wages before the official payday. In return, employees pay a nominal service fee, which serves as a primary revenue source for Wagestream.

2. Employer Partnerships: Mutual Benefits

Wagestream collaborates with various employers, providing their employees with the Wagestream service. In return, the company forms partnerships with these employers, receiving a share of the service fees paid by the employees.

3. Integration Services: Enhancing Payroll Systems

Wagestream integrates its technology seamlessly into the existing payroll systems of employers. This integration incurs a setup fee and ongoing maintenance charges, adding another layer to Wagestream’s revenue stream.

4. Data Insights: Value-Added Analytics

With access to employee financial data, Wagestream generates valuable insights for employers. These insights aid in better understanding employee financial wellness and drive informed decision-making. Wagestream monetizes this information by offering data analytics services to partner employers.

5. Interest Income: Borrowing Option for Employees

Wagestream extends an additional service allowing employees to borrow funds against their future earnings. The interest charged on these borrowings contributes to Wagestream’s revenue pool.

6. Subscription Models: Tailored Plans

For employers seeking more comprehensive services, Wagestream offers subscription models that provide enhanced features and benefits. These subscription packages generate recurring revenue.

7. Investment from Stakeholders: Fueling Growth

To further fund its operations, Wagestream secures investments from stakeholders, both venture capitalists and institutional investors. These investments provide capital for expansion and innovation.

Challenges Faced by Wagestream

Like any innovative concept, Wagestream faces its own set of challenges. Regulatory compliance, data security, and concerns about fostering responsible financial behavior among employees are some of the hurdles the company navigates as it strives to provide a holistic solution.

Future Growth Prospects

As Wagestream gains traction and awareness, its future growth prospects appear promising. The shifting dynamics of the workforce, increased demand for financial flexibility, and the company’s ongoing efforts to refine its offerings position Wagestream as a key player in the fintech industry.

Wagestream FAQs

How secure is Wagestream’s financial data?

Wagestream employs stringent security measures to safeguard financial data, including encryption and compliance with industry standards.

Can employees borrow unlimited funds through Wagestream?

No, Wagestream sets limits on borrowing to ensure responsible use and prevent excessive financial strain on employees.

Are the data insights provided by Wagestream identifiable to individual employees?

No, Wagestream anonymizes and aggregates data to protect the privacy of individual employees while offering valuable insights to employers.

What is the typical service fee for using Wagestream?

Service fees vary, but they are generally a small percentage of the accessed amount, ensuring affordability for employees.

How does Wagestream contribute to financial wellness?

By providing timely access to earned wages and promoting responsible borrowing, Wagestream empowers employees to manage their finances effectively.

How does Wagestream ensure fair interest rates for employee borrowings?

Wagestream adheres to regulatory guidelines while determining interest rates, ensuring transparency and fairness in its lending practices.

Conclusion

The “How does Wagestream Make Money?” article has uncovered the intricate revenue model that fuels Wagestream’s innovative solution. Through a combination of service fees, employer partnerships, integration services, data analytics, interest income, subscription models, and stakeholder investments, Wagestream has not only redefined financial flexibility for employees but also established a sustainable and thriving business model.

This comprehensive understanding sheds light on Wagestream’s pivotal role in revolutionizing the traditional pay cycle and promoting financial well-being for individuals across industries.

Also Read: How does Mudflap Make Money? (6 Ways Explained in Detail)